Mid-Market Inbound Signals give mid-market companies a more accurate, actionable way to qualify leads based on real behaviors rather than self-reported data. By tracking high-value actions, aligning marketing and sales, and applying predictive models, organizations can improve conversion rates and resource efficiency. Embracing these signals is key to building smarter, more effective inbound marketing programs.

Mid-market companies are increasingly leveraging behavioral signals to improve lead qualification, streamline sales processes, and maximize ROI. Unlike traditional methods that rely on self-reported data, Mid-Market Inbound Signals track what prospects actually do—pages visited, content consumed, and resources downloaded—to reveal genuine buying intent. These signals help marketing and sales teams align their strategies, prioritize high-value prospects, and predict future behavior. Below are 10 commonly asked questions about how mid-market organizations can implement, measure, and benefit from Mid-Market Inbound Signals.

The Limitations of Traditional Qualification

Traditional qualification methods relied heavily on asking prospects to self-report their interests, needs, and purchase timelines. The problem? People often don’t accurately describe their own intentions. A director who claims to be “just researching” might actually be deep in the buying process. Meanwhile, someone who selects “immediate purchase timeline” might simply want quick access to gated content.

Traditional qualification methods relied heavily on asking prospects to self-report their interests, needs, and purchase timelines. The problem? People often don’t accurately describe their own intentions. A director who claims to be “just researching” might actually be deep in the buying process. Meanwhile, someone who selects “immediate purchase timeline” might simply want quick access to gated content.

Mid-market marketing teams discovered this disconnect through experience. High-scoring leads frequently went nowhere, while seemingly casual browsers suddenly converted without warning. This inconsistency highlighted the limitations of traditional lead qualification approaches.

Behavioral Signals: Actions Speak Louder

Behavioral signals reveal what prospects actually do, rather than what they say they’ll do. These digital footprints provide remarkably accurate insight into genuine buying intent. When someone visits your pricing page multiple times in a week, they are actively evaluating costs, regardless of what they selected on a form. When they scrutinize customer case studies in their industry, they are envisioning implementation. These actions reflect authentic interest that traditional metrics cannot capture.

Mid-Market Inbound Signals are emerging as a critical solution. Unlike self-reported data, these signals track actions that truly indicate readiness to buy. For example, when prospects navigate from general product pages to specific solution content, these Mid-Market Inbound Signals indicate a higher likelihood of conversion. Similarly, repeated engagement with testimonials or ROI calculators provides strong evidence of intent.

Key Behavioral Patterns That Indicate Buying Intent

Certain behavioral patterns consistently correlate with higher conversion rates across mid-market companies. Page sequencing matters enormously. Prospects who move from general information to specific solutions to implementation details typically show stronger intent than those who bounce randomly between topics. Content consumption depth also reveals engagement level. Someone who reads a complete case study guide signals different intent than someone who merely scans headlines. Return frequency tells a compelling story; repeated visits to specific resources often indicate internal discussions are happening between visits. Tracking these patterns as Mid-Market Inbound Signals can dramatically improve lead scoring accuracy.

At InboundMarketo, we’ve observed that these patterns remain consistent across industries, though the specific signals may vary. Mid-Market Inbound Signals allow marketers to move from guesswork to data-driven decision-making, optimizing efforts toward prospects who are genuinely likely to convert.

Implementation Without Enterprise Budgets

Many mid-market companies assume sophisticated behavioral tracking requires enterprise-level technology investments. The reality is different. Many existing marketing platforms now include capabilities that were once premium features. The key is not to buy new tools but to fully utilize the ones already in place.

Start by identifying 3-5 high-value actions that typically precede purchases in your specific business and track them consistently. These actions become your primary Mid-Market Inbound Signals. Once your team gains confidence, expand to more complex behavioral signals to refine lead scoring model seven further. By leveraging Mid-Market Inbound Signals, mid-market teams can significantly increase efficiency, focus on the right leads, and ultimately drive higher conversion rates without massive budgets.

In conclusion, relying solely on self-reported data is no longer sufficient. Mid-Market Inbound Signals provide a more accurate, actionable, and cost-effective way to qualify leads, helping marketing teams understand what prospects truly want and when they are ready to buy. Embracing these signals is key to building smarter, more effective inbound marketing strategies in the mid-market space.

The Privacy-First Approach

With increasing privacy regulations, ethical tracking becomes essential. Fortunately, the most valuable behavioral signals don’t require invasive data collection.

Focus on first-party data, information gathered directly through interactions with your own digital properties. This approach respects privacy while still providing remarkably accurate qualification insights.

Be transparent about data usage. Many mid-market companies find that customers actually appreciate personalization when it’s clearly explained and delivers genuine value.

Aligning Marketing and Sales Around Behaviors

Behavioral qualification works best when marketing and sales teams align on which signals matter most. This alignment requires breaking down traditional department boundaries and fostering collaboration across teams. Without it, valuable insights from either team can be overlooked, leading to missed opportunities and inefficient resource allocation. Mid-market companies that successfully integrate Mid-Market Inbound Signals see more accurate lead scoring and a smoother handoff from marketing to sales.

Behavioral qualification works best when marketing and sales teams align on which signals matter most. This alignment requires breaking down traditional department boundaries and fostering collaboration across teams. Without it, valuable insights from either team can be overlooked, leading to missed opportunities and inefficient resource allocation. Mid-market companies that successfully integrate Mid-Market Inbound Signals see more accurate lead scoring and a smoother handoff from marketing to sales.

Sales teams often identify behavioral patterns that marketing may miss. Their direct customer interactions reveal which pre-purchase behaviors are genuine indicators of buying intent. For example, a prospect who repeatedly asks about integration capabilities may be closer to purchase than someone who only downloads whitepapers. These insights become part of the Mid-Market Inbound Signals framework, helping marketing refine lead scoring models.

Meanwhile, marketing sees trends across larger prospect populations that individual sales representatives might not detect. By analyzingclick paths, content engagement, and resource downloads at scale, marketing can identify patterns that consistently precede conversions. Combining these perspectives ensures that Mid-Market Inbound Signals capture both qualitative and quantitative insights, providing a holistic view of prospect intent.

Examples of Mid-Market Inbound Signals by Stage

| Buyer Stage | Example Actions | Signal Type | Indicative Intent |

|---|---|---|---|

| Awareness | Visits blog post or resource page | Early-stage | Low-level interest |

| Consideration | Downloads case study, compares solutions | Mid-stage | Evaluating options |

| Decision | Visits pricing page, requests demo | Late-stage | High purchase intent |

| Loyalty | Revisits knowledge base, engages with updates | Post-purchase | Retention and upsell potential |

Beyond Basic Tracking: Progressive Behavioral Profiles

Leading mid-market companies now build progressive behavioral profiles that evolve as prospects engage more deeply with content. Rather than making a single qualification decision, these profiles continuously refine the understanding of each prospect’s journey. Initial website visits might indicate awareness, while subsequent actions such as repeated visits to case studies or pricing pages signal deeper interest. These cumulative behaviors form the foundation of Mid-Market Inbound Signals.

Progressive profiles allow companies to predict purchase timing and product fit more accurately. Early interactions establish baseline interest, mid-stage behaviors reveal specific needs and concerns, and late-stage actions indicate buying authority and readiness to commit. By continuously updating these profiles with new data, marketing and sales teams can respond dynamically rather than relying on outdated or static lead scores.

Behavioral Signals with Recommended Marketing & Sales Responses

| Behavioral Signal | Recommended Marketing Action | Recommended Sales Action |

|---|---|---|

| Multiple visits to pricing page | Send automated cost comparison content | Schedule personalized demo |

| Downloads technical whitepaper | Add to nurture sequence with solution guides | Follow up with technical consultation |

| Engages with ROI calculator | Trigger advanced educational emails | Offer consultation on ROI outcomes |

| Repeated visits to case studies | Promote industry-specific webinars | Share relevant client success stories |

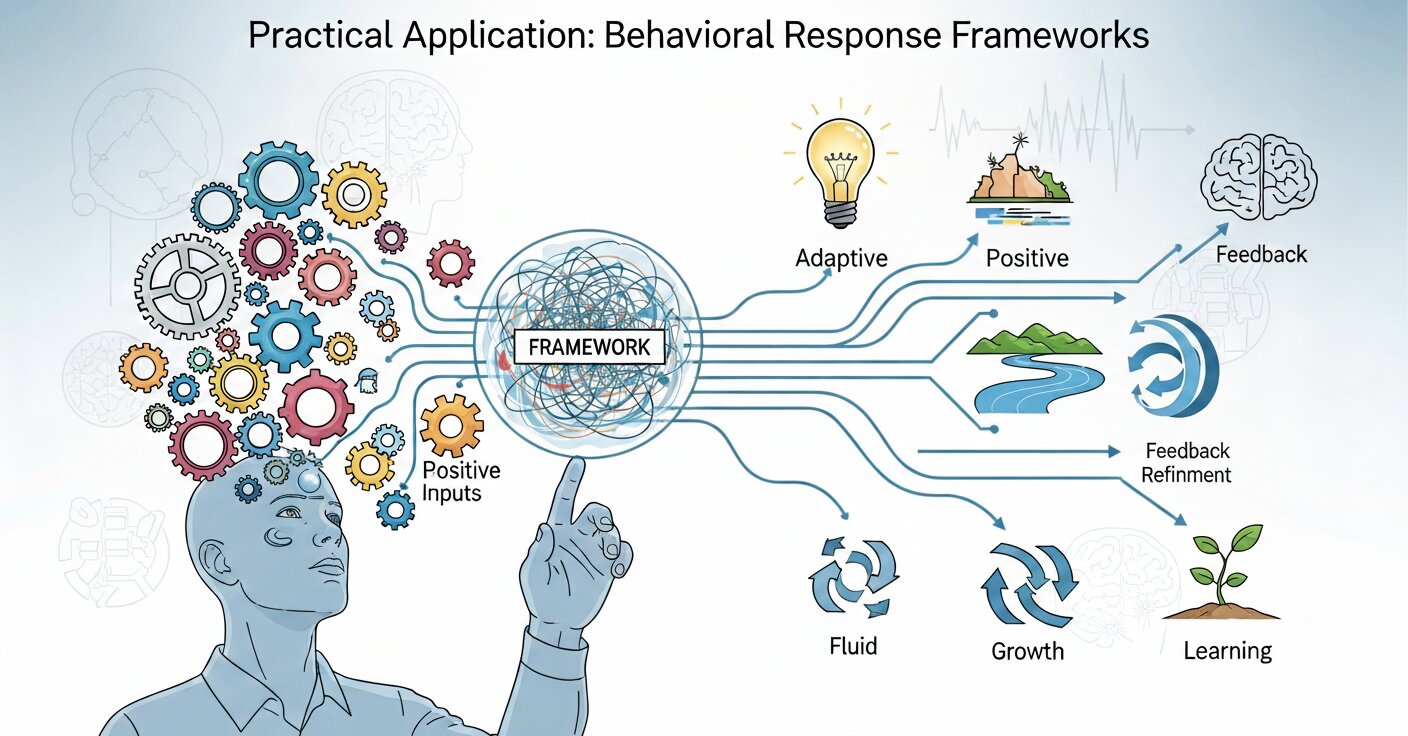

Practical Application: Behavioral Response Frameworks

The most effective mid-market inbound programs develop specific response frameworks triggered by behavioral signals. When prospect behaviors indicate early-stage evaluation, automated nurture sequences might deliver comparative content or educational materials addressing common questions.

As prospects engage with more in-depth resources—such as ROI calculators or technical whitepapers—Mid-Market Inbound Signals identify them as ready for more personalized outreach. Sales can then intervene with timely, relevant messaging, dramatically improving conversion rates. By mapping responses to specific behavioral patterns, companies ensure that every prospect receives the right type of communication at the right moment.

Measuring Impact: New Qualification Metrics

Traditional lead scoring focused largely on quantity: how many MQLs entered the pipeline. Behavioral qualification, however, demands more sophisticated measurement. Forward-thinking mid-market companies now track predictive accuracy, measuring how often Mid-Market Inbound Signals correctly anticipate purchase decisions.

Engagement quality is prioritized over simple volume. Metrics such as content consumption depth, repeat visit frequency, and resource interaction patterns indicate genuine interest. Most importantly, companies measure revenue impact rather than raw lead counts. The ultimate test of any qualification system is whether it identifies prospects who actually become paying customers.

The Future: Predictive Behavioral Qualification

As mid-market companies master basic behavioral tracking, many are moving toward predictive models that anticipate future behaviors. These systems do more than react to prospect actions—they forecast likely next steps based on patterns from previous buyers.

Predictive models rely heavily on Mid-Market Inbound Signals to allocate resources efficiently. For example, prospects who display repeated engagement with implementation-focused content may be fast-tracked to sales outreach, while those in earlier stages continue to receive educational nurturing. This approach ensures marketing and sales resources are used where they generate the highest ROI, shortening sales cycles and improving conversion outcomes.

Getting Started: The Incremental Approach

Implementing behavioral qualification does not require a full-scale system overhaul. The most successful mid-market companies start by identifying just a few high-value signals and expanding gradually. Begin by analyzing your existing customers’ journeys to determine which behaviors consistently preceded purchases. These behaviors form your initial Mid-Market Inbound Signals.

Test these signals with a small segment of prospects to validate accuracy and effectiveness before scaling across the broader audience. Once proven, add additional signals and refine response frameworks. This incremental approach minimizes disruption while demonstrating clear ROI for broader implementation.

The transformation in qualification methodology represents more than a tactical adjustment—it is a fundamental shift in how companies understand buying intent in the digital age. Mid-market companies that embrace Mid-Market Inbound Signals gain the ability to allocate resources efficiently, improve conversion rates, and accelerate growth. By focusing on actionable behaviors rather than self-reported intentions, marketing and sales teams can build smarter, more precise inbound programs that drive measurable results.

Frequently asked questions

What are Mid-Market Inbound Signals?

Mid-Market Inbound Signals are behavioral indicators that show a prospect’s actual engagement and intent, such as visiting pricing pages, downloading case studies, or repeatedly returning to specific resources.

How are these signals different from traditional lead qualification?

Traditional qualification relies on self-reported data like form selections or demographic information. Mid-Market Inbound Signals are based on real actions, providing more accurate insight into purchase intent.

Why are these signals important for mid-market companies?

They allow mid-market companies to prioritize high-intent leads, improve conversion rates, and allocate marketing and sales resources more efficiently, even without enterprise-level budgets.

Which prospect behaviors are typically considered high-value signals?

High-value signals include repeated visits to pricing pages, engagement with case studies, interaction with ROI calculators, and navigating from general information to product-specific content.

How can marketing and sales teams align around these signals?

Teams should collaborate to define which behaviors matter most, track them consistently, and establish response frameworks so both marketing and sales take timely, coordinated actions.

Do mid-market companies need expensive tools to track these signals?

No. Many existing marketing platforms already include behavioral tracking capabilities. The key is to fully utilize these features and focus on the most meaningful signals.

Can these signals predict future purchases?

Yes. When tracked over time, Mid-Market Inbound Signals can form the basis of predictive models that forecast likely next steps, enabling proactive outreach.

How should companies measure the effectiveness of these signals?

Instead of just counting leads, companies should track predictive accuracy, engagement quality, and revenue impact to evaluate the success of Mid-Market Inbound Signals.

How can companies start implementing behavioral qualification?

Begin by identifying 3–5 high-value signals from past customer behavior, test them with a small segment of prospects, and gradually scale while refining the scoring and response frameworks.

Is privacy a concern when tracking these behaviors?

Privacy regulations can be respected by focusing on first-party data, collecting information directly from interactions on your own digital properties, and being transparent about how the data is used.